Table of Contents

TLDR – How to import from China to the UK (in a nutshell)

- Importing from China to the UK is very doable if you follow a clear process: choose the right product, find and vet suppliers, order samples, negotiate, calculate landed cost, sign a solid contract, agree safe payment terms, control quality, and plan shipment.

- The model you use matters: direct importing gives maximum control and slightly sharper unit prices, while working with a China-based sourcing company reduces risk and workload and is often better for SMEs and brands without a team in China.

- Landed cost must include more than the factory price: add freight, insurance, UK duty, VAT, port and handling fees, customs/brokerage charges, UK haulage, devanning/palletisation and bank/FX costs, then divide by units to see the real margin.

- Documentation and compliance are non-negotiable: EORI, commercial invoice, packing list, bill of lading, commodity code, any required import licences, plus meeting UKCA/CE, safety, timber and other sector-specific standards.

- Quality control should be planned, not reactive: at minimum, UK importers should use pre-shipment inspections, with mid-production and container loading checks for higher-risk or fragile goods.

- Shipping is usually by sea, using standard 20ft, 40ft or 40HQ containers; LCL can work for small orders but FCL gives a lower cost per cubic metre and less handling. Transit times and rates vary, so always confirm current estimates with a freight forwarder.

- A sourcing company such as Easy Imex can act as an on-the-ground partner in China, handling supplier selection, negotiation, quality control, consolidation and shipping, so UK businesses can focus on sales and brand growth.

Many UK businesses are interested in importing from China to UK. For many, this may seem like a daunting task. However, with a strong understanding of the process it can be done with ease.

In 2025, importing from China to the UK still makes sense for many businesses, even with higher freight costs than before COVID, post-Brexit customs formalities and stricter VAT rules. The key is to choose the right products, calculate landed costs accurately, and plan shipments and pricing so that duty, VAT and logistics are fully built into your margins.

This guide will walk you through the steps to import from China to UK, help you define a good business model for buying from the different types of Chinese suppliers, give you an understanding of duty and tax rules, and guide you through pre-import considerations.

The content is aimed at UK SMEs, e-commerce brands, Amazon and marketplace sellers, and established retailers who need a realistic, step-by-step view of importing from China to UK – from choosing products and suppliers to understanding duty and tax rules, quality control, and pre-import requirements.

It is structured around 10 key steps:

- Select product to import from China to UK

- Find the right supplier

- Select and contact the best Chinese suppliers

- Sampling

- Negotiation

- Calculate your landed cost

- Purchasing

- Payment options

- Quality control

- Shipment

.

How to Import from China to the UK: 10 Key Steps

Thousands of British companies are earning massive and consistent profits by buying from Chinese manufacturers and importing from China to UK.

It is seemingly easy to do. Just find a product, choose a Chinese factory that can produce it cheaply, introduce it into the UK market, optimize your branding/marketing, and let the cash roll in!

However, those of you who have attempted to import products themselves will well know that doing it right seems easy but is in fact quite challenging.

There are a huge number of challenges that importers must rise above. Getting branding and marketing right, which is no small task, is just the beginning.

Here at Easy Imex, we are a sourcing company that has helped hundreds of importers grow their businesses over the years. To help you scale yours, we have consolidated this information into this step-by-step guide detailing the techniques that have worked for those companies.

.

By learning from our many client’s perspectives on what works and what doesn’t, we’ve been able to refine how we coach our clients in mastering the importing from China to UK process for maximum success.

1) Select the Right Product to Import from China to the UK

While choosing the right products is important for success, it is less crucial than might be expected in building a successful brand selling Chinese manufacturer sourced products.

Nearly every product has a niche. What is more important for your business is to understand the right way to source your product.

Indeed, when choosing the right product, you must consider the market environment and your available budget. However, with sufficient capital and an appropriate strategy, you can be confident in your success.

For example, if your product involves wooden components or natural materials, you must consider the requirements around legally sourced timber from China to UK—especially if you’re targeting eco-conscious consumers or industries subject to regulatory oversight.

What follows are 7 key principles for product selection that I’ve learnt through helping 100’s of businesses import product from China.

Over the years, helping hundreds of businesses import products from China, I’ve identified seven key principles that the most successful importers follow. Those companies that experienced success obeyed the following principles:

Tip #1: Building a brand around a product is the best thing you can do

Brands are crucial for connecting with people. Rather than simply attempting to sell online a commoditized product that only competes on price, creating a brand that connects with your customers builds a long-lasting business model.

Tip #2: Stay away completely from fad products

The lifecycle of hyped/fad products is very short because the novelty fades quickly for consumers. It is impossible to build a brand around them.

Instead, as mentioned above, make the choice to focus on your long-term brand by choosing products that bring sustainable profits.

In addition, be aware that novelty products often have quality problems that are not fully resolved because they are by nature new to market. Consider hoverboards, for example. They had to be recalled because of a dangerous battery issue, hurting the brand image of companies that were selling the boards to consumers.

Tip #3: Have at least one unique selling point or differentiator

Without a point of difference (POD) that separates your product from the competition, it is hard for your product to be successful. That said, there is no need for the POD to be significant. It can be as simple as a unique color scheme, a special logo that stands out from the crowd, an excellent unboxing experience, or superior marketing photos.

To begin with, keep it simple by only focusing on one or two PODs. Once your brand begins to experience growth, you can begin implementing incremental improvements so as to separate your brand/product from your competitors.

Tip #4: Don’t neglect product safety

When you import from China to UK, stay away from dangerous products. Dealing with product liability and recalls can totally destroy your business. As mentioned above, more than 5,000,000 hoverboards sourced from Chinese manufacturers had to be recalled in the United States because of unsafe batteries, wiping out many importers.

Tip #5: Perfect must not get in the way of good

It is common for companies to try to take on too much at once at the beginning and struggle to get anywhere. I’ve seen it many times.

It is wise to have a plan for added product features, design improvements, and customizations, but it is unnecessary to have this all figured out before you make your first order from your Chinese supplier.

I suggest only sticking to a couple of products at the beginning. Do them well! As your business grows, build out your product lines.

There is no need to do everything at once.

For the UK market, always cross-check whether your product falls under any special safety, UKCA/CE marking or timber regulations before you fully commit.

Once you have selected a product that fits these principles, the next step is to identify reliable Chinese suppliers who can manufacture it consistently for the UK market.

2) Find the Right Supplier in China for the UK Market

Online Supplier Directories (Alibaba, Made-in-China, Global Sources, DHgate)

Finding the right supplier is one of the biggest drivers of long-term success when importing from China to the UK. In practice, most importers use a mix of three channels to find partners: online supplier directories, trade shows, and specialist sourcing companies based in China.

Alibaba

Alibaba.com takes the prize as the largest supplier directory in the world with an estimated 8.5 million active sellers and 279 million active buyers and is mainly set up as a B2B service.

No matter your product or niche, it is nearly certain that you will find the right manufacturer for it. Because the majority of manufacturers have a MOQ (minimum order quantity), you are forced to buy in bulk.

In terms of getting a great price this is good, but when you’re just starting out this can be a financial stretch. For UK importers, it’s important to treat Alibaba as a starting point rather than a guarantee of reliability – always verify business licences, product compliance and trade history before committing to larger orders. To find manufacturers and suppliers on Alibaba, simply search for the item with the words: ‘manufacturer’ or ‘private label’ in the search box.

.

If you take the step to become a verified buyer, you can obtain access to a more complex and detailed directory of suppliers. This gives you the capability to find experienced suppliers, see some of their most important customers, research their trade records, as well as other background information.

Although it is still possible to find trusted manufacturers without becoming a verified buyer, as a verified buyer you have greater security and information. I also recommend seeking out Gold Suppliers which Alibaba has verified.

Tradeshows

Trade shows are ideal for UK importers who want to meet factories face to face, see product quality in person, and compare multiple suppliers in a single trip.

- Chinese trade shows

Not only is China the largest manufacturer in the world, but it’s also one of the most common destinations for online sellers to source their manufacturing from to import from China to UK. There are a variety of excellent trade shows to choose from if you want to travel to China to meet in person with manufacturers. Some of the largest shows are Guangzhou’s Canton Fair, Shanghai’s Import and Export Commodity Fair, and Zhejiang’s Yiwu Commodities Fair. - UK trade shows

Additionally, the UK hosts trade shows for nearly each industry. The M+A Expodatabase is an excellent resource, giving information on a current listing of nearly all the UK’s trade shows organized by product niche.

For many UK businesses, domestic trade shows are a low-risk way to research product categories and shortlist potential Chinese suppliers before committing to factory visits in China.

Using a sourcing company

The sign of a great sourcing company is that they can find manufacturers that you and your competitors are unable to.

A sourcing service based in China has the advantage of being able to search in Chinese, utilize local connections, and tap into their already existing supplier database.

Here at Easy Imex, we discover the majority of our top suppliers through industry connections and tradeshows.

For UK-based businesses, working with a sourcing company in China is effectively like having a local team on the ground. They can screen factories, negotiate in Chinese, manage samples and quality control, and coordinate shipments to UK ports while you focus on sales, branding and operations.

In addition, we hunt down factories the old-fashioned way, by travelling to the districts where a product is manufactured and finding producers that are not listed on Alibaba or similar sourcing company platforms.

What makes this a possible approach is that Chinese towns and cities oftentimes specialize in producing only one kind of product.

Furthermore, we narrow the search down by figuring out the raw materials for production, and the exact expertise required to make the product.

It is typical for only one or two places to exist in China where the superior Chinese manufacturers are located for producing our client’s product.

When we have found the place we want to visit, we’ll travel there and speak with Chinese manufacturers that we’ve already sourced from.

Next, we’ll seek out factories that only produce for the domestic Chinese market and ask them if they know the best factories for exporting the types of product we want to sell internationally. Factories that only produce for selling domestically don’t have a problem sharing this information because it doesn’t detract from their business.

Global Sources

Beyond Alibaba, there are several other online directories that UK importers can use to cross-check prices and suppliers, including Global Sources, Made-in-China and DHGate. Each platform has slightly different strengths, so it’s sensible to compare offers across more than one site before you decide who to work with.

Founded in 1970, Global Sources have the advantage of being in business 29 years longer than Ali Baba. Based in Hong Kong, Global Sources’ focus is primarily business-to-business. Because they were founded in America, viewing and navigating the Global Sources site has always been a more user-friendly experience for westerners than other Chinese sourcing sites.

Global Sources have facilitated over 1.5 million worldwide buyers, and 95 of the world’s most successful top 100 retailers have used their services for product sourcing.

Because bigger doesn’t always equate with better, many buyers and importers prefer Global Sources over Ali Baba. Global Sources have a reputation for high quality and careful vetting of suppliers.

Global Sources are niche-focused, so for companies in the electronics, home and gift, or fashion sector, Global Sources is often their preferred choice. Rival Chinese sourcing companies can spread themselves too thin, and many users prefer Global Sources’ specialized approach.

Conversely, some users find the lack of a rating and review system to be a barrier in finding the best products to sell. For that reason, you should weigh your options carefully before choosing to opt for Global Sources as your choice of sourcing platform.

Made In China

Unlike the other major sourcing directories in China, Made In China focuses primarily on construction and industrial products. As a result, Made In China caters to sectors like sporting goods, agriculture, automotive products, and electronics.

Some prospects will find a barrier with Made In China’s 500-piece minimum order quantity. While a buyer can ask for a few sample items, the seller may not meet the request.

Product information on Made In China is involved and in-depth. You will find accurate and comprehensive information on Chinese suppliers and their products on the Made In China website.

Made In China is particularly popular and trusted in the UK, EU, and the USA; it has a transparency that other sourcing platforms lack. Online reporting and inspection options assist in finding reliable and honest suppliers.

However, expect to pay more for products than you would on Ali Baba, for example. If price is your prime consideration, another choice of platform will better suit your needs than Made In China.

D H Gate

E-commerce specialist DH Gate has a reputation as a safe and reliable online shopping platform. Usually, their products are low priced with no MOQ. As a result, DH Gate is attractive to small and medium-sized companies, and upfront spending is generally lower.

DH Gate protects buyers in various ways.

With the seller feedback facility, prospects can check ratings before buying.

Managed Services From DHGate is a system for offering third-party payments. The third-party hold payments until product delivery. When the buyer confirms receipt of goods, payment is released.

Additionally, DH Gate mediates any disputes that occur in the buying process.

These services provide many users with a secure, safe buying experience. However, there are still questionable sellers on DH Gate. As ever, I advise you to do due diligence and tread carefully before making a buying decision.

3) Select and Contact the Best Chinese Suppliers

How to Structure Your RFQ and First Email

It is crucial to format your initial RFQ (request for quotation) and outreach email correctly. A clear, well-structured message will increase the response rate from Chinese manufacturers and make it much easier to compare and track potential suppliers.

.

You should demonstrate in your email that you are a potential long-term customer, and that you run a professional, reliable operation that legitimately wants to import from China to the UK.

In practical terms, your initial RFQ email should:

- Be concise and easy to scan (short paragraphs and bullet points)

- Clearly state that you are based in the UK and plan to place repeat orders if the first cooperation goes well

- Include the key terms for raw materials, testing requirements, and critical components

- Attach a simple product spec sheet (drawings, dimensions, materials, finishes, packaging requirements)

- Ask for concrete next steps (for example: “Please confirm MOQ, unit price under FOB [Port], lead time, and whether you already export to the UK/EU.”)

For UK importers, it also helps to mention your target UK port of discharge and preferred incoterm (usually FOB or CIF), and to ask whether the factory already understands UK/EU standards for your product category. This filters out suppliers who are not set up for exporting to the UK early in the process.

I typically begin by sourcing 10-15 suppliers that seem suitable. Next, I consolidate that list to the top 3-5 suppliers based first on price, then on lead times, factory size, quality (have samples sent to you), and compliance ability.

I recommend paying most of your attention to the 3-5 superior suppliers because any more than that leads to difficulty and high cost in arranging the samples and inspecting the factories.

Visiting a supplier’s factory is the single best way to verify whether a supplier is suitable.

Visiting the factory allows you to check out the equipment, determine the factory’s capacity, and examine the quality of the sample room, the factory’s own quality control systems, and the quality of the factory employees.

Additionally, it gives you direct access to the factory’s leaders to negotiate pricing face to face.

In particular, for businesses that are already established and hoping to import from China to UK, this is a crucial step and must not be skipped!

If you are unable to spend the time in travelling to the other side of the world to inspect potential Chinese suppliers, you should hire a 3rd party sourcing company to inspect your potential supplier list.

How can I verify a Chinese supplier?

In order to verify whether a Chinese supplier is the right choice for you, take the following questions into consideration:

Question #1 – Is the factory capable of producing my product? Are they experienced in this particular product area?

It is a common tendency for Chinese manufacturers to say yes to the majority of requests. Be aware of this. When asking one whether they have the capability to manufacture your product, it is rare to get a no answer!

Ask for evidence from the factory that they are capable of manufacturing your product if you have doubts.

Question #2 – Are they a manufacturing company or a trading company?

It is easy to spot trading companies. It is likely they are a trading company if they are selling a wide variety of goods across many different product categories.

If you plan to import from China to UK and would like more information on why you should avoid buying products from a trading company, read this article.

Question #3 – Are you able to effectively communicate with the Chinese manufacturer?

When importing from China to UK, if communication is something the factory is bad at, you likely do not want to have dealings with them. If something went wrong with an order, you might have to wait weeks for an explanation as to why!

Question #4 – How will the Chinese supplier’s location impact product cost and lead times?

China is a huge nation. If you purchase a product from Yichang, for example, you must consider the extra costs and time required to deliver the product to the nearest ocean port.

You must ensure that you are buying your product from the best regions.

In almost every instance, if you are purchasing electronics, you should be buying from a factory close to Shenzhen. More information on China’s manufacturing geography and the impact it has on product sourcing decisions can be found here.

Question #5 – Is the factory sufficiently large? Can they handle my order volumes?

It doesn’t make sense to purchase from China to UK from a factory incapable of managing your order volumes. Ultimately, they will probably outsource production to another, often worse, factory.

On the other hand, if your plan is to import small quantities from China to UK, don’t buy from a massive Chinese factory because you will not be important to them, and will probably have your order placed at the end of the line when a larger order comes along, leading to delays.

4) Sampling: Test Products Before You Commit

Sampling is the stage where you confirm what you will actually receive once you place a full order. A well-managed sampling process reduces the risk of disputes, quality complaints and costly returns once your goods arrive in the UK.

At the very least, I recommend obtaining samples from the top two suppliers on your shortlist.

Make sure to be diligent when examining your Chinese suppliers’ samples. The majority of people don’t take sufficient care with the sample examination process.

Pay attention to the feel, look, function, dimensions, packaging, and performance of your product.

I also suggest asking more than a single person check the samples so that key details aren’t missed.

In the case that the product needs mail order packaging, ask that any sample that the factory sends to you is sent with the same mail order packaging that they will use on your order later.

Next and highly important when you import from China to UK is to conduct drop tests on your product. Ensurng that the packaging is sufficiently sturdy to handle being imported from China to UK. For more information on the right way to conduct drop tests, check out this article.

For UK importers, the sampling stage is also the best time to confirm that your product can meet any UK or EU requirements that apply to your category – such as UKCA or CE marking, fire safety standards, electrical safety, toy regulations or timber legality rules. If testing is required, it is far better to discover issues at the sample stage than after a full shipment has been produced.

If the Chinese manufacturer is unable to match your requirements, then unless you want to make compromises, the proposed factory is basically unsuitable.

Once you are happy with a sample, document it carefully: take clear photos from multiple angles, record all key dimensions and materials, and label it as the “golden sample”. Make sure the factory understands that mass production must match this approved sample exactly.

Several side points:

It is normal in China for samples to be redeveloped and redone so that they can reach your desired outcome. Be careful about writing off a factory too quickly if they don’t produce a perfect first sample.

If your company is developing a new product and samples are expensive to make, it may not make much sense to arrange for samples from 2 different suppliers. Instead, it may be best to work with the best supplier and arrange for a sample to be made with them.

Another important point to consider is the required time for the sample process. This can take a considerable amount of time in the case of more complex and custom products, but in other cases, it can be as quick as placing a sample order and submitting a payment online.

If your product requires extensive customization, from materials, color, molds, etc. Make sure you plan for the appropriate amount of time that it requires to validate every detail. In some cases, it’s possible to request general samples of the materials or colors from the manufacturer; this could help you save time in the process.

How to ask for a specific color in a sample? If your product requires a very specific color or if you just want to reduce the margin of error and details like issues with color calibration, a good solution is to rely on trademarked colors and samples, such as Pantone. You can purchase physical samples, swatches, or color books and use those as a reference when requesting samples. Bear in mind that not all manufacturers will have the required equipment but any factory with a professional team should be able to produce products according to their color catalog, potentially saving you time and money during the prototyping and sampling process.

Once your golden sample is approved, you are in a much stronger position to negotiate pricing, payment terms and lead times, because both you and the factory now share a clear reference for the final product.

5) Negotiation with Chinese Suppliers

Chinese suppliers are extremely good at negotiating. If you come to the table unprepared, you will almost certainly overpay or accept unfavourable terms.

Follow the tips below when importing from China to the UK to obtain the best results when negotiating with Chinese suppliers:

Tip 1. Do good research. You must be sure of your bill of materials and product specifications; you need to know where the factory is based in China and what it is like. You must obtain quotes from several different factories so as to have a basis for comparison, and you must understand how your product will be produced.

If you don’t have this information you will be incapable of effective negotiation and you will lose your credibility with the Chinese supplier.

Tip 2. Only conduct negotiations with suppliers on your shortlist. You are wasting time by negotiating with suppliers that aren’t capable of meeting your requirements for quality or compliance.

Tip 3. You must understand your Chinese manufacturer. Will it offer you better lead times and pricing because you will be one of their first international customers, or is it a well-established supplier with high MOQs, an extensive existing client base, and limited interest in smaller UK orders?

On the other hand, is it a well-established supplier with high MOQs (minimum order requirements), an extensive existing client base, and a low level of interest in your company?

Tip 4. Define a negotiation strategy according to the quality level, lead times, and price level you are targeting.

For example, is the price the main concern?

Or, is it also important that your factory use the components and materials that comply with a standard?

Will you pay a bit of a higher unit price if a factory has shorter production lead times?

Tip 5. Present a good business case and backstory to the factory. The days are gone when every Chinese factory is desperate for your business regardless of your purchase order size. If you are able to present a clear business case on how you want to import from China to the UK, the Chinese factory will better understand your goals and how they can support you.

Tip 6. Conduct your negotiations with the appropriate person at the factory. For small and medium-sized factories, it’s usually best to negotiate with the boss, as he or she will be the main decision maker and have the final say on reducing prices below standard rates.

Tip 7. Stay strong. Use your research, and if you’re visiting Chinese suppliers for negotiations, don’t be persuaded by emotional triggers and expensive lunches.

Tip 8. Don’t overlook terms of payment when negotiating with your factory supplier. Typically, payment terms are a 30% deposit and the remaining 70% paid once your goods have been produced by the factory and have passed a pre-shipment inspection successfully.

Strong payment terms not only improve your cash flow but also reduce your risk if something goes wrong with the order.

The results of your negotiations on price, payment terms and lead times will flow directly into your landed cost calculations, which we cover in the next step.

What Are the Standard Minimum Order Quantities (MOQ) for UK Imports?

If you’re planning to import from China to UK, you should acknowledge that each supplier has different minimum order quantities. In the section that follows, we will make note of various methods of procuring products in China and outline for you what typical minimum order quantities to expect.

.

6) Calculate Your Landed Cost from China to the UK

Landed costs are extremely important. You must know your landed cost per unit if you want to understand your true profit margin and whether a product is worth importing from China to the UK. If you ignore landed costs and only focus on the ex-factory price, you risk selling at a loss once duty, VAT and freight have been added.

The total cost of producing and importing your product to your distribution center/warehouse in the market you are selling in is called your landed costs, or landed pricing.

eCommerce sellers may also want to include courier costs and Amazon fees that are necessary to deliver your product to customers.

Why Is Landed Cost So Important for UK Importers?

You can ensure that your profit margins are sustainable and sufficient by carefully calculating your total landed cost.

It is also highly useful to know your landed costs, as they can act as a basis in negotiating prices with suppliers.

After calculating your landed costs, if they only allow for a 5% profit margin or less compared with the lowest selling price on the market, you have probably not done a good job of price negotiation and sourcing.

Key takeaways

Landed cost is important because it shows you:

- Whether a product is profitable once all costs are included

- What sales price you need to charge in the UK to maintain your target margin

- Whether it’s worth continuing with a supplier or product line at all

Without a realistic landed cost calculation, UK importers often underprice their products, underestimate cash flow requirements, or continue importing items that are not genuinely profitable.

How to Calculate Your Landed Costs (Formula and Required Data)

In simple terms, your landed cost per unit is the total of: product cost, international freight and insurance, UK import duty and other customs charges, VAT, and inland transport and handling, divided by the number of units in the shipment.

For example, if your total product and shipping costs are £10,000, UK duty and other charges are £1,000, VAT is £2,200, and inland delivery and handling are £800, your total landed cost is £14,000. If that shipment contains 1,000 units, your landed cost is £14 per unit.

Example of landed cost breakdown (per shipment)

Cost item | Amount (£) | Notes |

Product cost (FOB) | 10,000 | 1,000 units at £10 each |

Sea freight and insurance | 2,000 | 40ft container from China to a UK port |

UK import duty | 800 | Example: 8% duty rate on customs value |

UK port & terminal handling | 450 | Terminal handling and documentation fees |

Customs clearance / broker fees | 150 | Charged by freight forwarder or customs broker |

UK haulage to warehouse | 500 | Transport from UK port to your warehouse |

Banking / FX costs | 100 | Bank charges and exchange rate margin on supplier payment |

Total landed cost | 14,000 | Total cost for the full shipment |

Landed cost per unit | £14.00 | £14,000 ÷ 1,000 units |

Although making an accurate calculation is complicated, it is a crucial step that should not be skipped when you import from China to UK! Landed costs should be based on projected order volumes for your product, rather than the MOQ (minimum order requirements) received from the product’s factory.

Be careful about basing a decision on whether a product is viable simply on a MOQ trial order, because when ordering in larger quantities (full containers), you may be able to obtain a better price.

Or course, the costs for quality control and freight when purchasing from China to UK are much lower when calculated on a per unit basis if those costs are spread out over a larger quantity of products being shipped.

Buying in large quantities also gives you greater leverage when negotiating prices.

The following information is necessary when working out your total landed costs:

- The following are necessary for getting an accurate quote from your supplier: port of loading, incoterms, product pricing and details, total cubic meters of order, overall packaging size, currency of quote, and type of shipment (less than full container load, LCL, or full container load, FCL).

- A quote that is up to date from your customs clearance agent or freight forwarder that has: local charges at the country of import, freight costs from port of loading to port of discharge, trucking costs, local taxes, and local duty rates.

- Your actual exchange rate and currency costs. These are different than the trading price.

As I walk you through the landed quote formula and examples, I’ll assume for simplicity’s sake that you are using the FOB incoterm when purchasing from your factory supplier.

Most importers from China to UK use the FOB incoterm. If you would like to learn more about incoterms and why they are important to understand, click this link here.

Common UK-specific costs importers forget

Even experienced importers sometimes forget to include certain UK-side costs in their landed cost calculation. Some common items to watch out for are:

- UK port and terminal handling charges – fees for unloading and handling your container at the UK port

- Customs clearance and documentation fees – what your freight forwarder or customs broker charges to process entries in CDS

- UK haulage / last-mile delivery – transport from the UK port to your warehouse, fulfilment centre or Amazon FC

- Devanning, palletisation and short-term storage – especially if your container is unloaded at a warehouse or distribution centre

- Bank and FX costs – international transfer fees and exchange rate margins when paying Chinese suppliers in USD or RMB

If you leave these out, your real profit margin will always be lower than what you planned on paper.

7) Purchasing: Placing Your Order with a Chinese Supplier

There is a right way and a wrong way to do it when purchasing a product from China to UK. First of all, make sure you get a purchase contract in place. To do this correctly, your purchase contract must contain the following:

- Total quantities and unit prices

- Delivery dates and production lead times

- Late-delivery fines or penalties

- Incoterm and agreed ports (for example FOB Ningbo – UK destination port)

- Payment terms (deposit, balance, and when each is due)

- Agreed tolerances on quality, quantity and defects

- Agreed standards on quality and any required tests or certificates

- Detailed product specification, including materials, dimensions, packaging, labelling and instructions

A clear purchase agreement must be in place for any product imported from China to UK. It is essential. Don’t just discuss the above details, get them written up in an explicit agreement. This is especially important when importing into the UK, where you may need clear documentation to resolve disputes with factories, freight forwarders, insurers or even HMRC.

If you choose to work through a buying office, it is standard for them to create and manage the purchase agreement on your behalf, ensuring that all commercial and technical details are correctly captured.

Once your purchase contract is agreed and signed, the next step is to align on payment terms that balance your cash flow needs with the supplier’s expectations, which we cover in the following section.

.

8) Payment Options for Imports from China to the UK

Payment options can be negotiated, and they can vary in different circumstances – for example, depending on the size of your order, your history with the supplier, and how much risk each party is willing to accept. Most businesses that import products from China work based on the importer paying a deposit, and then later paying their balance shown on the bill of lading (once the Chinese supplier has shipped the goods from China to UK).

I’ve included some examples of payment terms from ‘worst case’ for you to ‘best case’.

100% payment prior to production beginning

This carries an extremely high risk because the importer lacks any leverage over the factory they are dealing with once the money has been paid. In general, this payment term would only be used if the placed order is minimal, which would be less than £3800, for example.

30% deposit then 70% prior to shipment

In this case, the importer first pays a 30% deposit to the manufacturer on the order. Once the goods are produced, the importer pays the remaining 70%. The goods can then be shipped. This is not the best scenario from either a cash-flow or risk perspective for the importer. If the Chinese manufacturer wanted these terms in the deal for any order greater than £7,600, it should be a warning sign that the manufacturer has a reason for offering such poor terms to the importer.

30% deposit, 70% against bill of lading

Any importer should expect these terms as standard for to import from China to UK. The importer pays a 30% deposit to the manufacturer, enabling the importer to have strong control over the quality of the goods being manufactured. Once the goods are shipped out of China and in a container on the way to them, the importer can pay the remaining 70% of the balance against the bill of lading. This strategy also enables importers to better manage their cashflow.

0% deposit, 100% against bill of lading

These are great payment terms for the importer. There is no required deposit, and the Chinese supplier agrees to manufacture the product according to the importer’s purchase order. Only once the goods have been shipped out of China and are on their way to the importer must the payment be made. These payment terms are generally only achievable if you’re working through a sourcing service, such as Easy Imex.

0% deposit 100% balance after 90 days (ordering goods on credit)

These are basically the best payment terms you can achieve for doing an import from China to UK. Getting credit terms from the Chinese manufacturer requires meeting specific criteria, such as contract history, credit checks, and trading history. These terms can basically only be earned through operating through a dedicated buying office like Easy Imex.

Comparison of common payment terms when importing from China

Payment term | Description | Risk for importer | Best used when |

100% payment before production | Full payment before any goods are made or shipped | High | Very small orders or samples with trusted suppliers |

30% deposit, 70% against bill of lading | Partial payment up front, balance after shipment (ideally after pre-shipment inspection) | Medium | Standard for many UK SMEs when starting with a new supplier |

30% deposit, 70% after goods arrive in UK | Balance paid after container arrives in UK (or after clearance) | Lower | When relationship is more established and supplier is flexible |

0% deposit, 100% after 60–90 days (open account) | Payment on credit terms after receipt of goods | Low | Long-term relationships, or when working via a professional buying office |

PayPal / credit card | Online payment via PayPal or card | Medium–High (fees + disputes) | Samples and very small trial orders |

In practice, most UK importers start with a 30% deposit and 70% balance against the bill of lading, link the final payment to a passed pre-shipment inspection, and reserve PayPal or card payments for samples or very small trial orders. More favourable terms such as 0% deposit with payment against bill of lading or 90-day credit are usually only achievable once you have built up a strong trading history or are working through a professional buying office.

9) Quality Control: How to Check Product Quality Before Shipping

All purchases when you import goods from China to the UK should be subject to a quality control assessment. No matter the size of the Chinese manufacturer, it is wise to have clear quality standards in place, as factories almost always have some degree of quality issues from time to time, and the level of risk can vary significantly from factory to factory.

It is worth observing that no matter the amount of quality control, you cannot turn a bad Chinese manufacturer into a good one!

As an importer, whether you are bringing in a single container load of products or a much larger volume, the impact on your business can be severe if you miss a quality issue on any batch.

Once your goods have been imported from China to the UK, they generally cannot be returned to the factory. Therefore, you as the importer must either sell the stock as a second-hand or discounted product, apply some form of damage control, or fix the mistakes and issues. In some cases you may have to sort out highly defective and unsellable stock from what is still sellable, or even dispose of the stock entirely if selling it would damage your brand – a tough decision that you hope never to face.

You could try to sort out highly defective and unsellable stock from that which is still sellable or make the decision to dispose of the stock because it cannot be sold as it would damage your brand. It is a tough decision that you hope you never have to make!

To avoid getting in that situation, each batch of the product should be quality checked! The following are various forms of quality control:

- Pre-shipment inspection – this is an inspection of the batch once production has finished.

- Online inspection – a Quality Inspector visits the factory every single day during the production process.

- Container load check – this method ensures that the shipping container is loaded correctly, and the right quantity of product is loaded. With fragile items such as glass this is especially crucial.

- Mid production inspection – making checks during the middle of production to make sure that the right colors/materials, etc., are used.

For most UK importers, a pre-shipment inspection is the minimum standard, with mid-production or online inspections added for more complex or higher-risk products, and container load checks used when loading fragile or high-value items.

Quality control options for UK importers

Inspection type | When it happens | What it checks | Typical use case |

Pre-shipment inspection | After production is finished, before balance payment | Random sampling, product quality, quantity, packing, labelling | Minimum standard for most UK importers |

Mid-production inspection | When 20–60% of production is completed | Materials, colours, processes, early-stage defects | New suppliers, complex products, tight timelines |

Online / during-production inspection | Regularly during production | Ongoing process control, key quality points | High-value products, ongoing orders, or when quality risk is higher |

Container loading inspection | During loading of the container | Quantity, packing, loading method, carton handling | Fragile or high-value goods such as glass, furniture, electronics |

The simple rule of thumb is that the more quality control you do, the less risk you will have! That said, you must find a balance between the amount of quality control you practice and the cost of conducting that quality control.

Working through a sourcing service, such as Easy Imex, gives you a built-in quality control team on the ground. They will assess each SKU (item) as well as each manufacturer and put in place the right quality control plan for you. Easy Imex exports over 20 million USD worth of goods each year for businesses importing from China to the UK.

In addition, the quality control team will help you create, manage and implement the plan. For example, if you are doing business with a new Chinese supplier, the first order will usually require a much higher level of inspection compared with a well-known manufacturer that has already built a strong track record.

Once your quality control plan is in place and inspections have been completed, you can move forward to the shipment stage with far greater confidence that the goods leaving China will match your expectations in the UK.

10) Shipment: Shipping from China to the UK

When you import from China to UK, the ideal way to ship these is ‘by the container load.’ Your product will be loaded into a container unless shipped by airfreight.

You can either import a ‘Less than a Container Load’ known as ‘LCL’ or a ‘Full Container Load’ known as ‘FCL’.

LCL vs FCL: Which Is Better for UK Importers?

LCL (less than a container load) shipments

LCL shipments may be the only option if you have a small order or even just a sample order. When your goods travel from the Chinese manufacturer to the port, they will be loaded into a ‘shared container’. When they arrive in your country, they will need to be unpacked from the container at the port so that your products can be delivered to you. This means that your products will be handled by a number of people before they are delivered, and those people may not treat your products with much care.

Because of this reality, LCL shipments are notorious for being damaged. If you are going to ship in this way, it is essential to ensure that your manufacturer has packed the product exceptionally well, something a sourcing agent can help with.

For UK importers, LCL can be useful for testing the market with smaller volumes, but you should expect a higher cost per cubic metre and a higher risk of minor damage compared with full container loads.

FCL (full container loads) shipments

If you order a full container load from a Chinese manufacturer, the shipping container will be delivered to the factory, and the factory will load your goods directly into it.

Once the container is fully loaded and the doors are closed, a seal is placed on the container. That seal will only be broken once the container arrives with you, the importer, which means no one else has handled the goods in between. The chance of damage when the goods arrive is very low, as long as the container has been correctly and carefully loaded.

The chance of damage when the goods arrive with the importer is very little as long as the container has been correctly and carefully loaded.

LCL vs FCL – quick comparison for UK importers

Option | Typical shipment size | Cost per m³ | Damage risk | Best for |

LCL (Less than container load) | Small shipments that don’t fill a full container | Higher (more charges per m³) | Higher – more handling and consolidation | Testing new products, low volumes, first trial orders |

FCL (Full container load) | load) Enough goods to fill a 20ft or 40ft container | Lower per m³ | Lower – sealed at factory then opened in UK | Established products, repeat orders, volume growth and better margins |

At Easy Imex we recommend and offer Container Loading Inspections for all importers. This ensures:

- That as the container is being loaded, the laborers do so with utmost care.

- That the correct quantity is recorded/loaded.

- That cartons are stacked the right way, ensuring that as they load products on the top part of the container, they are not damaging other units of product by treading on boxes at the bottom of the container.

Best size of container to import from China to UK

In general, no matter what country you are in, you should always use standard sized containers, 20ft, 40ft, 40ft HQ (High Cube).

Larger containers usually mean a lower cost per cubic metre, so your ultimate price on the imported product will generally be lowest if you use a 40ft container.

The reason for this lower cost is that the majority of ports around the world charge the same or a very similar amount of money to handle either a 20ft or a 40ft container.

Because the total cubic meter volume is more than double in a 40ft HQ container vs a 20ft container, the ocean freight per cubic meter is less than half in a 40ft container compared with a 20ft container.

The haulage/trucking cost must also be factored in. Because there is a similar trucking charge for a 40ft HQ container compared with a normal 40ft container, there is more value and overall lower cost per cubic meter by going with a 40ft HQ container.

The majority of companies that import from China to the UK choose to use a combination of a freight forwarding company and their procurement office to handle the shipment and logistics of their products.

The product procurement office handles everything until it is out of China; they will then provide both you, the UK importer, and the freight forwarding company you are using in the UK with all relevant documentation to import the product. These documents include a bill of lading, commercial invoice, packing list, etc.

The freight forwarder will then confirm and arrange both the customs clearance and co-ordinate delivery with you, the importer, once the container has arrived at your local port in the UK.

I want to reassure you that although the import–export process may seem daunting at first, the shipping and customs steps are typically one of the easier parts of the overall process once you have the right partners in place.

Shipping time from China to UK

It is important to know how long it will take to ship products you are importing from China to the UK. Transit time is impacted by shipment size, season, and location. The following table shows estimates on timing for each shipping mode from China to UK.

Transit times can also vary depending on the shipping line, route and congestion at ports, so always confirm up-to-date estimates with your freight forwarder when planning your orders.

Cost to Ship LCL Container from China to UK

The delivery location and the shipping term you agree with your supplier will determine the cost to import a 40ft container from China. An estimate for your total cost if you’re still in the planning stage is £2500-3000 + UK Duty & VAT although this will fluctuate. The cost should not be too much more than this and could be lower.

Cost to Ship FCL from China to UK

The shipping cost for a 20ft container imported from China to the UK will vary based on the agreed upon shipping terms with the producer and your exact delivery location. A good estimate for buying on FOB shipping terms is £1800-2000 + UK Duty & VAT, although this will fluctuate. The cost could even potentially be lower.

.

Business Models for Importing from China to the UK

Once you’ve decided to import from China to the UK, the next step is choosing how you’ll run the operation. In practice, most UK importers either buy directly from Chinese factories or work through a China-based sourcing company / buying office such as Easy Imex.

Importing Direct from Chinese Factories

Many people assume that direct importing from manufacturers is superior because you will cut out unnecessary costs and get the best price.

By using this model, you can talk with the Chinese factory directly (technicians, sales, and decision makers). I believe this is half true and half wrong. These days, there are many resources available that one can easily make use of and apply to your importing business. Of course, this approach costs you time, and time is money.

Although you may theoretically get the best price per unit on your goods when importing directly, you should also realize that operating through a China-based sourcing company will help quite a bit in growing your business faster.

They will enable rapid growth by taking away headaches you must deal with surrounding your product. So the real question is whether you have the time, expertise, and order volume to manage factories yourself, or whether it makes more sense to outsource that work.

Pros of direct importing from China to UK

- You have full control of the import process.

- Competitive unit prices in most cases, especially once you are ordering full containers from China to the UK.

- You have access to your manufacturers, and you will work directly with them.

Cons of direct importing from China to UK

- Most manufacturers require a high MOQ to manufacture your product. For factories to be competitive, they normally run production in a low profit big volume scenario. Additionally, the quality of parts, raw materials, and packages also play a big role.

- Most factories are oriented towards production and overlook other services they should offer. Few factories have a good knowledge of how to fully meet and solve customers’ needs and pain points.

- Some of the factories might not have an actual export license or real experience.

- You must invest a large amount of effort and time to deal with the whole import process and supply chain management and issues that might occur.

- Your import process can be slow because of language barriers, time-zone and cultural differences, and back-and-forth communication with Chinese factories.

Best for: established UK importers with strong cash flow, in-house operations support, and large, repeat orders who want maximum control and are comfortable handling supplier and logistics risk themselves.

Working with a Sourcing Company or Buying Office in China

Sourcing companies (also called sourcing agencies or buying offices) specialise in integrating supplier resources efficiently and serving multiple buyers at once. A good China-based sourcing company will typically have dedicated teams for supplier sourcing, quality inspection, warehousing, and shipping, making them especially useful for UK importers who don’t have staff on the ground in China.

Most sourcing companies have the capability to deal with everything from delivering the final goods at your warehouse to selecting the right Chinese supplier for you.

The sourcing company you are working with will also represent you at the factory by monitoring the mass production if necessary. Having a sourcing agent in China is much more convenient than having to fly all the way to your factory to check on them now and then.

The sign of a great sourcing company is that they provide transparency in terms of how suppliers candidates are selected. They can help you get a good idea of whether your potential supplier will perform well, will perform at a mediocre level, or will be horrible for you.

Easy Imex is a UK-owned sourcing company with more than 15 years of experience dealing with British importers. The company is based in Shanghai (China) and exports over 20 USD million worth of goods per year. Click on the button below to find out more about our sourcing services.

Pros of using a sourcing company to import from China to UK

In practice, a good sourcing company in China becomes your on-the-ground partner, handling supplier search, negotiation, quality control, and logistics coordination.

- You will get efficient and fast results and quick turnaround.

- You will have the supply chain management under full control by having professionals managing the entire import process.

- Professional sourcing agents are able to negotiate lower prices with factories than you may be able to.

- You will be able to devote your valuable time to operations, marketing etc.

- Value-added service like free package design, building a website, latest marketing information etc.

- The sourcing company is always a good helper for quality control.

Cons of using a sourcing company to import from China to UK

- They might be getting kickbacks from the factory that hurt your bottom line.

- May have less expertise than the actual Chinese manufacturers in specific product categories.

- It may still be challenging to find a truly satisfactory Chinese suppliers.

Best for: UK start-ups and growing brands that want expert support in China, lower risk, and a partner to manage supplier selection, quality control, and logistics end-to-end.

Which business model is right for you?

Direct importing from China to the UK is usually best if:

- You are an established UK importer with strong cash flow

- You can place regular, full-container orders

- You have in-house staff who can manage suppliers, quality control and logistics

- You want maximum control and are comfortable handling more operational risk

Working with a sourcing company in China is usually best if:

- You are a UK start-up or growing brand without a team in China

- You want help finding and vetting factories, negotiating and solving problems

- You prefer to outsource quality control, consolidation and shipping coordination

- You want to reduce risk and move faster, even if you pay a service fee

Pre-Import Considerations for UK Imports from China

When importing from China to UK, it’s essential to be clear on your pre-import checklist. Whether you work through a sourcing company or buy directly from a Chinese factory, you need to understand which documents are required, which UK quality and safety standards apply to your products, and whether any special sanctions, licences, or tariffs affect your HS code. Getting these foundations right reduces delays at UK customs, protects your margins, and makes the rest of the process much easier.

In practice, every UK importer should be clear on three areas before shipping:

– Documentation: invoices, licences, and customs paperwork for your shipment

– Quality & compliance: CE/UKCA marking, product safety, and sector-specific standards

– Import controls and tariffs: duties, VAT, and any bans, quotas, or surveillance on your product category

Documentation Required When Importing from China to the UK

Documentation is the paperwork customs and logistics partners use to identify your goods, assess taxes and duties, and confirm that you are authorised to import into the UK. Missing or inaccurate documents can cause delays, fines or even seizure of your goods, so it’s vital to understand what each document does.

Key documentation required for China to UK imports

Document | Who issues it | When it’s needed | Why it matters |

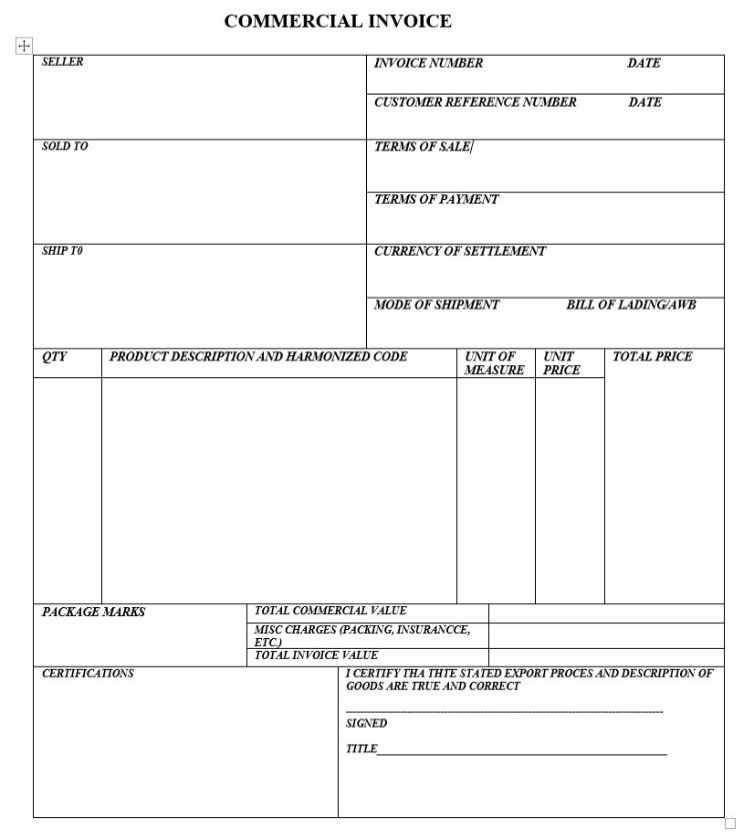

Commercial invoice | Chinese supplier | Before shipment and for customs entry | Used for customs valuation, duty and VAT calculation |

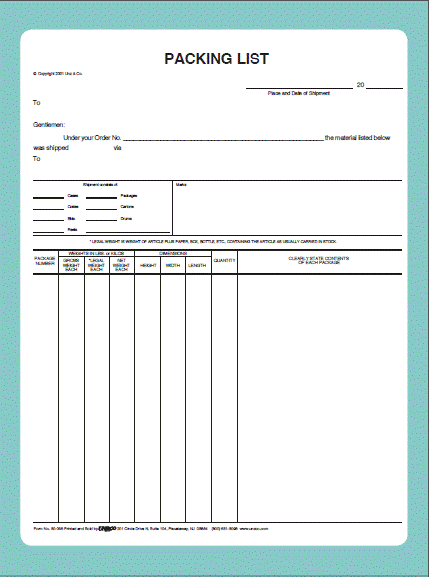

Packing list | Chinese supplier | With the shipment | Shows contents of each carton; helps customs and warehouse receiving |

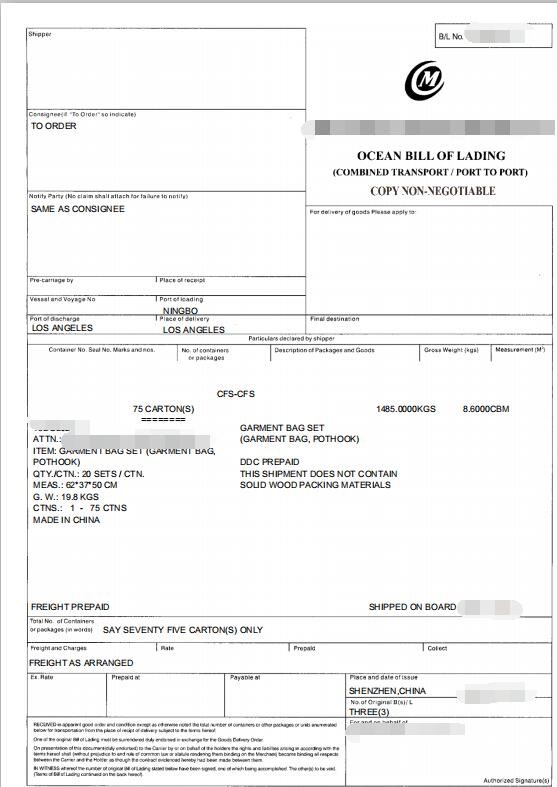

Bill of lading | Shipping line / forwarder | After container is loaded | Proof of shipment and, depending on terms, document of title |

Certificate of origin (if required) | Chamber of commerce / authorised body | Before clearance | Confirms where goods were manufactured; can affect duty and controls |

EORI number | HMRC (UK) | Before any commercial import | Identifies you as a UK importer in CDS and customs systems |

Commodity/HS code | Determined by importer (with advice) | Before customs declaration | Defines duty/VAT rate and whether product falls under special measures |

UK import licence (if required) | UK authorities (per product category) | Before shipment from China | Required for controlled goods under bans, quotas or surveillance |

Commercial Invoice

This important document gives a description of the products, verifies the sale, and reflects the consignment price. Customs valuation has its basis on the commercial invoice’s value. Customs will raise the alarm if there is any discrepancy between the rates charged in the commercial invoice and the normal value for the goods.

EORI Number (UK Economic Operator Registration and Identification)

Both imported and exported goods that pass through UK customs are tracked using an EORI number (Economic Operators Registration and Identification number). Any UK business importing commercial cargo from China is required to have an EORI number. It is used on commercial invoices and when submitting electronic import or export declarations through systems such as the Customs Declaration Service (CDS), and is also required for shipments handled by couriers and freight forwarders.

Applying for an EORI number is straightforward: you submit an online application to HMRC and will usually receive the number within a few days. The number is allocated to your business for ongoing use and helps customs identify you quickly, avoid delays and process your clearances efficiently.

The EORI number will be allocated through HMRC in the UK for the sake of customs clearance and custom access declaration.

The customs authorities grant EORI numbers to be used exclusively by a company for indefinite duration.

It is mandatory to have an EORI number because it enables you to avoid inconveniences that arise from deliberate possession of the consignment.

UK Import License

You must check whether you need a UK import licence before you import from China to the UK, especially if your goods fall under any surveillance or control category. Some products are subject to import controls such as bans, quotas or surveillance, and licences are more common for categories like agricultural goods, chemicals, pharmaceuticals, plants, live animals and certain medical products.

In the UK, import controls generally fall into three types:

– Bans – no import is allowed

– Surveillance – imports are monitored using licences

– Quotas – there is a limit on the volume that can be imported

For many industrial goods, an import licence is not required, but you should always check the rules for your specific HS/commodity code. If a licence is required, you should obtain it before shipping from China. You can find more information about which products need licences and how to apply on the main gov.uk import controls pages and the UK Department for Business and Trade / Department for International Trade websites.

Bill of Lading (B/L)

This document is a negotiable multi-modal document that the shipping line issues for transporting the product. It certifies the carriage of the cargo as stated in the specific invoice on behalf of the importer. This depends on the terms of sale. Put another way, this is the document that the agent or carrier issues to acknowledge your shipment and cargo.

It serves three primary functions:

– It shows the conditions and terms as well as the contract between the carrier and the importer.

– It serves as a document of title to the goods of course subject to the Nemodat rule.

– It provides a conclusive receipt acknowledging that the goods were loaded.

When purchasing from China to the UK, these are the main documents that you must produce. Of course, there are some additional ones that you’ll have to submit as a way of facilitating record keeping of the process or just as a formality.

There are also other necessary elements in the import process besides the importing documents. Keep the following highlights in mind:

Customs Registration (CR) Number and Power of Attorney (POA)

You must have a Customs Registration number (also known as a CR number) when importing or exporting goods from China to the UK.

This number is needed during the customs clearance process and is often shown on the commercial customs invoice. It verifies that you are a legal importer and authorised to carry out the business you’re in, helping to make your import process smoother and more efficient.

Certificate of origin

A certificate of origin states where your goods were manufactured. This document is used by UK customs to determine how your goods should be classified for duty purposes and whether they qualify for any preferential trade agreements. It also helps authorities apply any restrictions or special measures on goods coming from certain countries.

.

CDS (Customs Declaration Service – replacing CHIEF)

The UK now processes import and export declarations through the Customs Declaration Service (CDS). CDS is the system used by HMRC to handle electronic customs entries for goods moved by sea, land or air, and it is gradually replacing the older CHIEF system. Freight forwarders, customs agents and importers submit declarations through CDS so that customs can check entries, collect duties and taxes, control restricted goods, and compile accurate trade statistics.

Commodity Code

It is an integral part of UK importing to know and use the correct commodity code (also called the HS code). The commodity code is needed for customs declarations and other paperwork, and it tells you what duty and VAT must be paid, as well as whether any duty reliefs or trade measures apply to your product.

Packing list

The packing list gives detailed information about the parcels in the consignment. It provides an overview of the shipping marks, the net weight of each parcel, the number of units in each parcel, and the dimensions of each parcel. It is mandatory to place the correct shipping marks on all cargo so that customs and carriers can easily identify and handle each piece.

Essentially, all of this documentation makes it possible for you to make informed decisions, avoid unnecessary problems and keep your imports running smoothly. For the sake of your sanity, make sure your documents are in order before the goods leave China – it will also help you build a useful record for future shipments and repeated orders.

Quality Compliance Standards For Imports from China to the UK

You must have a strong understanding of quality standards if you want to import from China to the UK. The UK market does not compromise on safety, quality or compliance. As an importer, you must take into consideration that UK authorities keep superior standards in high regard.

There is high risk involved with knowingly importing products which are inferior in quality, ranging from health hazards to environmental degradation. Therefore, the UK government sets quality standard procedures to make sure they meet expectations. These procedures are well-established through a government body mandated to handle all import quality assurance.

In particular, when importing timber furniture from China, additional care must be taken to ensure the materials used comply with timber import laws in the UK. This includes verifying that you are sourcing legally sourced timber for furniture, as failure to do so can result in serious penalties. The importer is tasked by this agency in ensuring that their imported goods conform to the standards. You must also sign and keep a copy of the declaration of conformity for your particular product. These expectations serve to ensure that poor-quality products have a hard time entering the UK market. Low-quality products from low-quality Chinese suppliers could be seized, destroyed, or returned. Ultimately, this greatly benefits UK residents and the environment.

In practice, UK importers should focus on:

– Identifying which UK or EU standards apply to their product category (for example UKCA/CE, fire safety, electrical or toy regulations)

– Agreeing testing and certification responsibilities with the factory before production starts

– Keeping declarations of conformity, test reports and technical files on record in case authorities request them

– Choosing reliable suppliers who can consistently meet these standards over time

Import Sanctions, Duties and Tariffs on Goods from China to the UK

It’s important to research any specific sanctions or tariffs that may apply to the products you want to import from China to the UK. The most challenging aspect is that these rules can change frequently, so you must stay up to date with the latest official resources and regulations.

This is another aspect where professional help is highly recommended, as failure to comply with any existing regulations could result in a complete loss of your investment and time or it may add complexity to your business plan, often resulting in additional expenses that can be avoided.

For more information about Import Duties you can check our UK Import duties from China complete guide.

Also, it’s important to only rely on official sources of information, such as government websites or professional advice when it comes to making business decisions that may be affected by sanctions or special import tariffs. A good source for reference is the official website of the government, you can find more information on the link below:

https://www.gov.uk/business-and-industry/import-controls

Before committing to a new product line, always check current duty rates and any special measures for your HS code, and factor them into your landed cost and pricing strategy.

Quick UK Import Checklist (from China to the UK)

Before you place your next order, make sure you can tick off the following:

- Choose the right business model – decide whether to import directly or work with a sourcing company / buying office

- Validate your product and supplier – check demand and competition in the UK, shortlist reliable factories and approve a golden sample

- Confirm UK compliance – identify which UK and EU standards apply (UKCA/CE, safety, timber rules, etc.) and agree testing with the factory

- Calculate your landed cost – include product cost, freight, duty, VAT, UK handling and delivery so you know your true margin

- Sign a clear purchase contract – lock in specs, quality standards, tolerances, delivery dates, Incoterms and payment terms

- Agree safe payment terms – typically 30% deposit and 70% balance after a passed pre-shipment inspection for new suppliers

- Plan quality control – schedule inspections (pre-shipment and, if needed, mid-production or container loading checks)

- Prepare documentation – commercial invoice, packing list, bill of lading, EORI, commodity code, and any licences if required

- Coordinate shipping and customs – work with a freight forwarder to book space, file customs declarations in CDS and arrange final delivery in the UK

If you can confidently tick all these boxes, you’re in a strong position to import from China to the UK with far less risk and far fewer surprises.

Conclusion: Is Importing from China to the UK Right for Your Business?

Importing from China to the UK can be very profitable for your business if you approach it with a clear plan and the right partners. Here at Easy Imex, we hope this guide has strengthened your understanding of how to import from China to UK. If you have a firm foundation of understanding all the pieces of the puzzle, the process will not be too difficult. Whether you import directly or work through a sourcing company in China, the key is to put solid processes in place once and then repeat them, so each shipment becomes easier, less risky and more profitable over time. We are always here to assist you in taking your Chinese import business to the next level. Reach out to us today to get started!

Get in Touch Now!

Need professional help to import from China? Tell us your needs in the form below and our professionals will get back to you within 24 hrs.

FAQ – Importing from China to the UK

1) I want to import products from China to the UK – can you walk me through the process step by step?

Start by choosing a suitable product and checking UK regulations for that category. Then find and vet suppliers, request quotes (RFQs) and samples, and compare quality and pricing. Once you’ve chosen a supplier, negotiate terms and calculate your landed cost to confirm the product is profitable. From there, sign a purchase contract, agree payment terms, schedule quality inspections, and work with a freight forwarder or sourcing company to arrange shipping, customs clearance and delivery to your UK warehouse.

2) What documents do I need if I want to import from China to the UK?

You’ll normally need: a commercial invoice, packing list, bill of lading (or air waybill), certificate of origin (where required), and the correct commodity/HS code for your product. On the UK side, your business needs an EORI number, and customs declarations are filed through the Customs Declaration Service (CDS), usually by your freight forwarder or customs broker. Some products may also require import licences or additional certificates depending on the category.

3) Do I need an import licence for the products I want to bring from China into the UK?

Not all products require an import licence. Many industrial and general consumer goods can be imported under standard duty and VAT rules. However, categories such as agricultural products, some chemicals, pharmaceuticals, plants, live animals and certain medical products can fall under bans, quotas or surveillance and may need licences. Always check the rules for your specific HS/commodity code on gov.uk before shipping and make sure any necessary licence is approved before the goods leave China.

4) Can you help me understand how to calculate landed cost from China to the UK?

To work out your landed cost, add together:

– Product cost (ex-factory or FOB)

– International freight and insurance

– UK import duty and any additional customs charges

– UK VAT

– UK port and terminal handling fees

– Customs/brokerage fees

– UK haulage to your warehouse or fulfilment centre

– Any devanning, palletisation, storage and banking/FX costs

Divide the total by the number of units in the shipment to get a landed cost per unit. Compare this against realistic UK selling prices (after marketplace fees, if relevant) to see if the product is truly viable.

5) What are typical payment terms when buying from Chinese suppliers for the UK market?

For most new UK importers, a common starting point is T/T bank transfer with 30% deposit and 70% balance after production and a passed pre-shipment inspection, against the bill of lading. Letters of credit (L/C) can offer more protection but are more complex and usually make sense only for higher-value orders. PayPal or cards are best kept for samples or very small trial orders due to higher fees and weaker protection at scale. More favourable terms, such as payment after shipment or credit terms, are normally only offered once you have built a track record or work through a professional buying office.

6) I’m not sure whether to import directly or use a sourcing company in China – how should I decide?

Direct importing gives maximum control and can deliver slightly sharper unit prices, but it also demands more time, experience and internal resources to manage factories, compliance, quality control and logistics. A sourcing company in China can take care of supplier search, negotiation, QC, consolidation and shipping on your behalf, which often makes more sense for UK SMEs, new importers and brands that want to scale without building a team in China. The choice depends on your volume, risk tolerance, and how much of the work you realistically want to handle yourself.

7) What kind of quality checks should I plan when importing from China to the UK?

At minimum, most UK importers should arrange a pre-shipment inspection before the final balance payment is released. For higher-risk, complex or high-value products, it’s wise to add mid-production inspections or online inspections during manufacturing, and container loading checks for fragile goods such as glass or furniture. A China-based sourcing or QC team can help design a quality plan for each SKU and factory, and ensure issues are caught before the goods ship.

8) How long does it usually take to ship goods from China to the UK, and what should I expect?

Sea freight transit times depend on route, carrier and port congestion, but as a rough guide door-to-door can take several weeks from container loading in China to arrival at your UK warehouse. LCL (less than container load) shipments often take longer because of consolidation and deconsolidation. FCL (full container load) is usually faster and safer, with less handling. Transit times and rates can change with season and market conditions, so always confirm current estimates with your freight forwarder when planning your stock.

9) What UK compliance issues should I be aware of when importing from China?

Key issues include using the correct commodity/HS code, paying the appropriate duty and VAT, and ensuring your products meet all relevant UKCA/CE and safety standards. Depending on the category, this can include electrical safety, toy safety, fire safety, timber legality, food-contact rules or other sector-specific regulations. Many regulated products need testing, technical documentation and a declaration of conformity. Authorities can request documentation and test reports, so keep proper records for each regulated SKU.

10) What are the most common mistakes UK businesses make when importing from China – and how can I avoid them?